Stock trading in Australia offers investors a wide range of opportunities to participate in various markets and sectors. With a well-regulated financial system and a stable economy, Australia provides a conducive environment for stock trading. Whether you are a beginner looking to enter the world of stock trading or an experienced investor seeking to expand your portfolio, understanding the key aspects of trading stocks in Australia is essential.

Overview of Stock Trading Opportunities in Australia:

Australia has a dynamic stock market with a diverse range of listed companies across different sectors such as mining, finance, healthcare, technology, and consumer goods. The Australian Securities Exchange (ASX) serves as the primary platform for trading stocks in the country. The ASX is one of the leading exchanges in the Asia-Pacific region and facilitates the trading of a wide range of securities, including equities, bonds, and derivatives.

Key Trading Strategies:

When trading stocks in Australia, investors can adopt various strategies to maximize returns and manage risks. Some popular trading strategies include:

1. Fundamental Analysis: This strategy involves analyzing a company’s financial performance, management team, industry outlook, and macroeconomic factors to determine the intrinsic value of its stock.

2. Technical Analysis: Technical traders use historical price and volume data to identify trends, patterns, and signals for making trading decisions.

3. Momentum Trading: Momentum traders focus on buying stocks that are experiencing an upward trend in price and selling stocks that are experiencing a downward trend.

4. Value Investing: Value investors look for stocks that are trading below their intrinsic value based on fundamental analysis.

Current Market Trends:

The Australian stock market has experienced significant growth in recent years, driven by strong economic fundamentals and a boom in commodity prices. Some of the current market trends in Australia include the rise of technology stocks, increasing interest in renewable energy companies, and the impact of global events on the stock market.

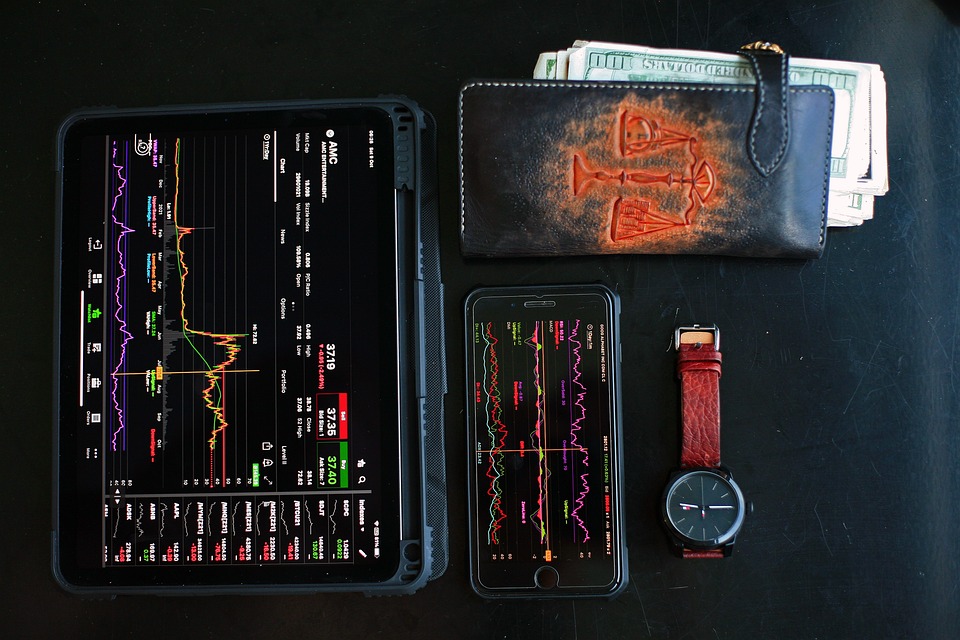

Trading Platforms:

Trading stocks in Australia can be done through online brokerage platforms that offer access to the ASX and other global markets. Popular trading platforms in Australia include CommSec, CMC Markets, and IG Markets. These platforms provide investors with real-time market data, research tools, and trading capabilities.

Performance Metrics:

When evaluating the performance of stocks in Australia, investors can use various metrics such as price-to-earnings ratio (P/E), earnings per share (EPS), return on equity (ROE), and dividend yield. These metrics help investors assess the value and growth potential of a stock.

Market Analysis:

Market analysis plays a crucial role in stock trading in Australia. Investors need to stay informed about macroeconomic trends, company news, regulatory changes, and geopolitical events that can impact stock prices. Conducting thorough research and analysis helps investors make informed decisions and mitigate risks.

Trading Techniques and Portfolio Management:

Effective stock trading in Australia requires a disciplined approach and sound risk management practices. Some key techniques to enhance trading performance include diversifying your portfolio, setting stop-loss orders, and implementing a systematic trading plan. Portfolio management involves monitoring the performance of your investments, rebalancing your portfolio as needed, and adjusting your trading strategies based on market conditions.

Tips for Effective Stock Trading:

To succeed in stock trading in Australia, investors should consider the following tips:

1. Set clear investment goals and risk tolerance levels.

2. Stay informed about market trends and company news.

3. Avoid emotional decision-making and stick to your trading plan.

4. Continuously monitor your portfolio performance and adjust your strategies accordingly.

5. Seek advice from financial professionals or experienced traders for guidance.

In conclusion, trading stocks in Australia offers investors a wealth of opportunities to capitalize on the country’s vibrant stock market. By understanding key trading strategies, market trends, trading platforms, and performance metrics, investors can navigate the complexities of stock trading in Australia with confidence. Implementing effective trading techniques, portfolio management practices, and following tips for successful trading can help investors achieve their financial goals and build a robust investment portfolio.