Stock trading in Australia offers investors a wide range of opportunities to capitalize on the country’s robust economy and vibrant stock market. As one of the most stable and advanced financial markets in the world, Australia provides numerous options for traders looking to diversify their portfolios and potentially achieve high returns.

Overview of Stock Trading Opportunities in Australia:

Australia’s stock market is dominated by the Australian Securities Exchange (ASX), which is the primary exchange for trading stocks in the country. The ASX lists over 2,200 companies, including large-cap stocks such as BHP Billiton, Commonwealth Bank, and CSL Limited, as well as smaller companies across various industries.

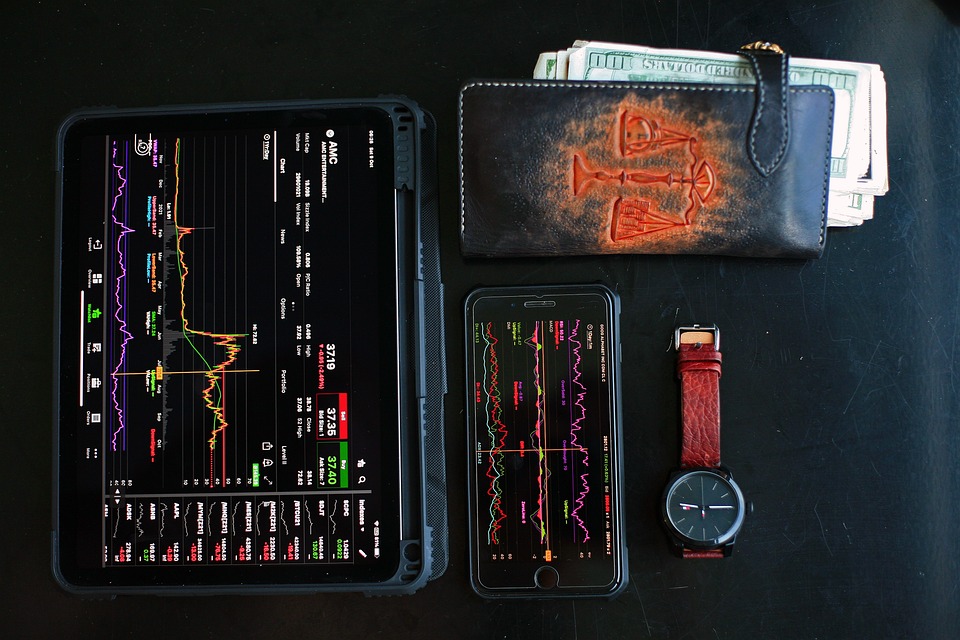

Investors can trade Australian stocks through online brokerage platforms, which offer a wide range of tools and resources to help traders make informed investment decisions. These platforms provide access to real-time market data, research reports, and trading tools that can help investors analyze stocks, monitor their portfolios, and execute trades efficiently.

Key Trading Strategies:

There are several key trading strategies that investors can utilize when trading stocks in Australia. These include:

1. Long-Term Investing: This strategy involves buying and holding stocks for an extended period, with the expectation that their value will appreciate over time. Long-term investors focus on fundamental analysis, such as company financials and industry trends, to identify undervalued stocks with growth potential.

2. Day Trading: Day traders buy and sell stocks within the same trading day, taking advantage of short-term price fluctuations to make quick profits. Day trading requires a high level of skill and discipline, as traders need to closely monitor market movements and execute trades quickly.

3. Swing Trading: Swing traders hold stocks for a few days to a few weeks, aiming to profit from short-term price swings. This strategy combines technical analysis, such as chart patterns and indicators, with fundamental analysis to identify trading opportunities.

Current Market Trends:

The Australian stock market has experienced significant volatility in recent years, driven by global events such as the COVID-19 pandemic, geopolitical tensions, and economic uncertainties. Despite these challenges, the ASX has rebounded strongly, with many companies reporting solid earnings growth and resilient business performance.

Trading Platforms:

There are several popular trading platforms in Australia that cater to both novice and experienced traders. Some of the top platforms include CommSec, IG Markets, and CMC Markets, which offer a wide range of features such as live trading charts, research tools, and mobile trading apps for on-the-go trading.

Performance Metrics and Market Analysis:

When trading stocks in Australia, investors need to pay attention to key performance metrics and market analysis to make informed decisions. Some of the important metrics to consider include price-to-earnings ratio (P/E), earnings per share (EPS), and dividend yield, which can help investors evaluate a stock’s valuation and growth potential.

Trading Techniques and Portfolio Management:

Successful stock trading in Australia requires a solid understanding of trading techniques and portfolio management. Investors should diversify their portfolios across different asset classes and industries to reduce risk and maximize returns. Additionally, using stop-loss orders, setting risk management rules, and sticking to a trading plan can help traders avoid costly mistakes and minimize losses.

Tips for Effective Stock Trading:

To become a successful stock trader in Australia, it’s important to stay informed about market trends, economic indicators, and company news. Traders should also be disciplined, patient, and willing to adapt to changing market conditions. By following a well-defined trading strategy, conducting thorough research, and continuously improving their skills, investors can increase their chances of achieving profitable outcomes in the stock market.

In conclusion, trading stocks in Australia offers investors a wealth of opportunities to grow their wealth and achieve financial goals. By leveraging key trading strategies, utilizing advanced trading platforms, and staying informed about market trends, investors can navigate the complexities of the Australian stock market and build a successful trading portfolio. With the right tools, knowledge, and mindset, anyone can embark on a rewarding journey in the world of stock trading in Australia.