Stock trading in Australia offers a plethora of opportunities for investors looking to diversify their portfolios and potentially generate significant returns. With a robust financial market, stable economy, and a wide range of investment options, Australia is a popular destination for both domestic and international investors looking to trade stocks.

Overview of Stock Trading Opportunities in Australia:

The Australian stock market is home to a diverse range of companies spanning various industries, including finance, mining, technology, healthcare, and consumer goods. Some of the most prominent companies listed on the Australian Securities Exchange (ASX) include Commonwealth Bank of Australia, BHP Group, CSL Limited, and Woolworths Group, among others.

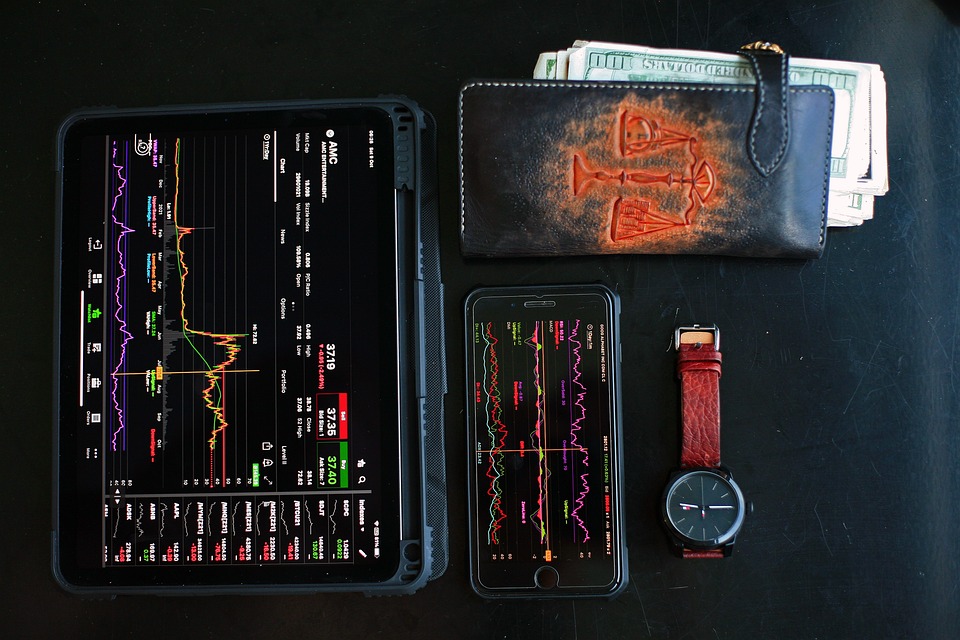

Investors can trade Australian stocks through a variety of channels, including online brokerage platforms, traditional stockbrokers, and financial institutions. Online trading platforms have gained popularity in recent years due to their convenience, low fees, and easy access to real-time market information.

Key Trading Strategies:

To navigate the Australian stock market successfully, investors should have a solid understanding of key trading strategies. These strategies include fundamental analysis, technical analysis, momentum trading, value investing, and growth investing. Fundamental analysis involves evaluating a company’s financial health, including revenue, earnings, and cash flow, to determine its intrinsic value. Technical analysis, on the other hand, focuses on statistical trends and chart patterns to predict future price movements.

Momentum trading involves buying stocks that are gaining momentum in the market, while value investing focuses on buying undervalued stocks with the potential for long-term growth. Growth investing, on the other hand, involves investing in companies with strong growth potential in revenue and earnings.

Current Market Trends:

In recent years, the Australian stock market has seen significant fluctuations due to various factors, including economic uncertainty, geopolitical tensions, and the impact of the COVID-19 pandemic. However, despite these challenges, the market has shown resilience, with certain sectors, such as technology and healthcare, outperforming others.

As of now, the Australian stock market has rebounded from the lows of the pandemic-induced market crash, with the ASX 200 index hitting record highs. Investors should closely monitor market trends, economic indicators, and company-specific news to make informed trading decisions.

Trading Platforms and Performance Metrics:

When trading stocks in Australia, investors can choose from a variety of online trading platforms, such as CommSec, Bell Direct, and SelfWealth. These platforms offer a range of features, including real-time market data, research tools, and customizable portfolios. Investors can also track their performance using key metrics, such as return on investment (ROI), earnings per share (EPS), price-to-earnings ratio (P/E), and dividend yield.

Market Analysis and Trading Techniques:

Market analysis plays a crucial role in stock trading, as it helps investors identify potential opportunities and risks in the market. Investors can use various tools and techniques, such as trend analysis, support and resistance levels, and moving averages, to make informed trading decisions.

Moreover, investors should employ effective trading techniques, such as setting stop-loss orders, diversifying their portfolios, and managing risk effectively. Portfolio management is also essential, as it involves regularly monitoring and rebalancing investments to maximize returns and minimize losses.

Tips for Effective Stock Trading:

For investors looking to trade stocks in Australia, here are some tips to consider:

1. Conduct thorough research on companies and industries before making investment decisions

2. Diversify your portfolio to spread risk and optimize returns

3. Set realistic financial goals and stick to your trading strategy

4. Stay informed about market trends, economic indicators, and company news

5. Seek advice from financial experts and leverage online resources for trading insights

In conclusion, trading stocks in Australia offers a wide range of opportunities for investors looking to capitalize on the dynamic and ever-evolving market. By employing key trading strategies, utilizing online trading platforms, and staying informed about market trends, investors can maximize their returns and build a successful stock portfolio.